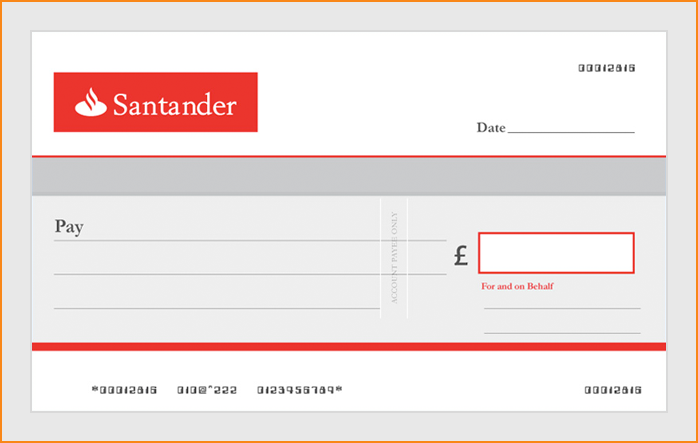

Santander Pay In Cheque

You’re already doing pretty much everything on your phone, whether it’s connecting with friends or colleagues or paying bills through your mobile banking app. But are you using mobile check deposit?

There are many benefits to utilizing the mobile check deposit functionality – we’ve listed out top three below.

If you wish to send a payment in the form of a personal check, cashier’s check or money order via overnight mail, certified mail or next day air, please make it payable to Santander Consumer USA and send it to: Santander Consumer USA; 1010 W. Mockingbird Lane, Suite 100; Dallas, TX 75247; Mailed payments only accepted at this location.

1. Because your time is important.

Your time is valuable, and unless you need to talk to a banker about other financial concerns, you don’t want to waste yours getting to a bank branch or ATM. Depositing your check by phone is fast, and can be done almost anywhere – as long as you have cell service or Wi-Fi!

2. Because you don’t want overdraft fees.

To deposit cash at a Post Office, you'll need: your debit card and PIN; or your Basic Current Account cash card and PIN. The maximum cash deposit limit is £20,000, though some Post Office branches can only allow up to £1,000. Santander Consumer USA Inc. Accepts payments from personal checking or savings accounts via our interactive telephone system. Simply call us toll-free at 1-888-222-4227 and have your account number and your checking or savings account information ready when you call. There’s no change to the way cheques should be banked due to the new imaging system. However, cheques banked into Santander Corporate accounts are expected to be processed by cheque imaging from approximately September 2018. When a cheque is processed this way you’ll notice much quicker outcomes. Clearance timescales for banked cheques.

Look, nobody likes fees. If you’re not able to get to the bank in the near future but you still have expenses coming up, like your rent or your monthly Netflix payment, now’s the time to mobile deposit any outstanding checks you have. That way you’ll have enough time to get funds into your account, and hopefully avoid any overdraft fees when it comes time to make your next payment.

Not sure if your balance is low? You can go ahead and set up mobile alerts to make sure you’re always informed.

3. Because you’re on the go.

Even if you’re out of town, that doesn’t mean your bank account is out of reach. Maybe you’re visiting family for the holidays and you got a check from your favorite aunt. Or, you’re attending a school far from home and somebody paid you by check. You don’t want to wait to get home to be able to access your cash! Even if you’re not in the same ZIP code as your bank, it doesn’t mean you have to put your life on hold. Use mobile deposit to get your funds, faster.

Santander Pay In Cheque Through App

How long does mobile deposit take?

Mobile check deposit takes only a few minutes. But there is processing time involved, just like any deposit. If you’re banking with Santander, when you deposit a check before 10 pm on a business day, it counts as being deposited on that day. You’ll be able to access up to $200 of the amount you deposited the next business day, however you won’t be able to access the rest of the deposit amount until the check clears. This usually happens within two business days of the deposit.

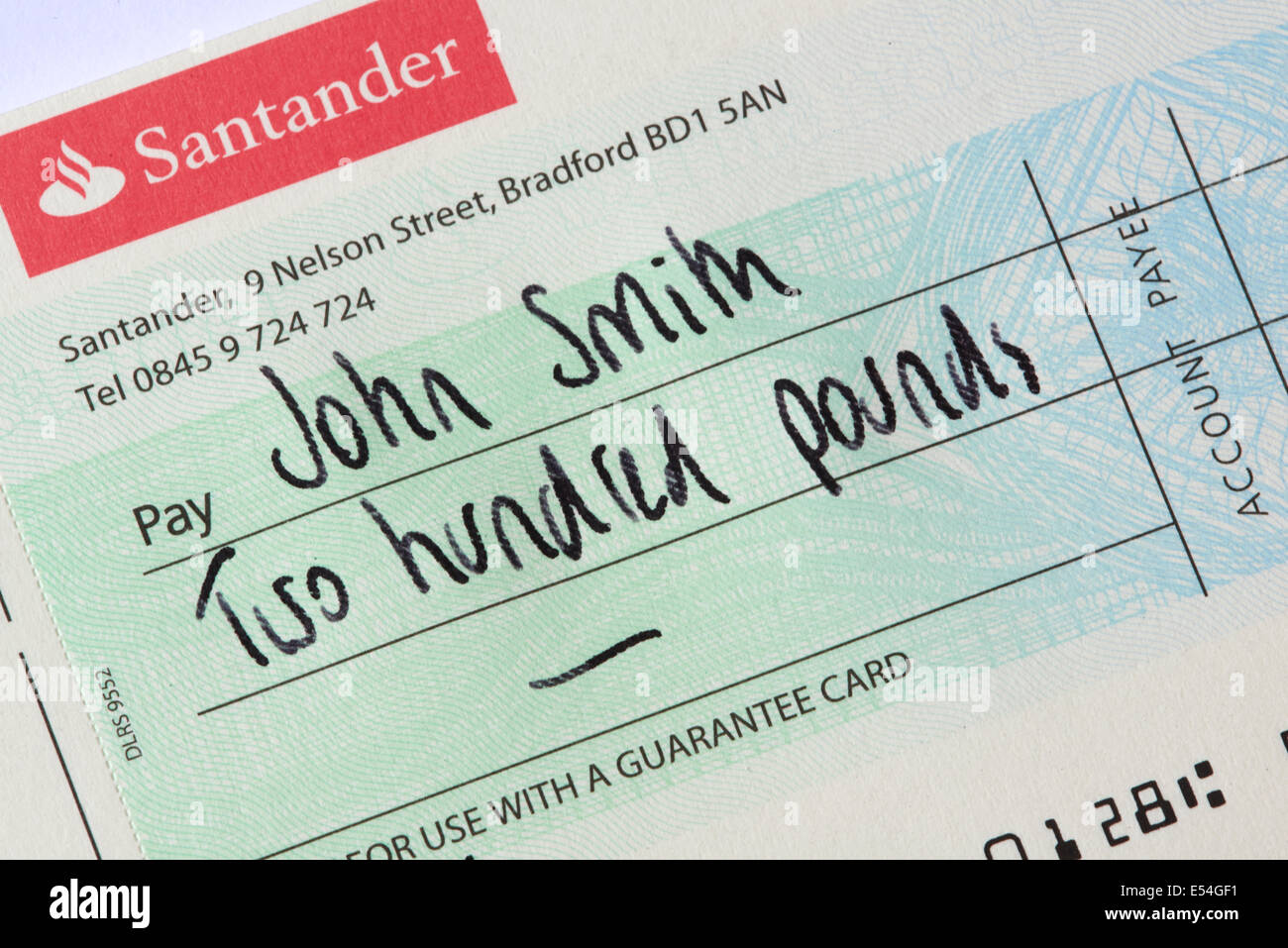

How does mobile deposit work?

Mobile deposit works simply—just point, click and confirm. Take a picture of your check through your bank app and click through the steps on screen. You’re all done! Learn how to download our app and get started with Santander mobile check deposit.

Santander Pay In Cheque Via App Uk

To use the Santander Mobile Banking App, you must first accept the Online Banking Agreement. Data connection required. Message and data rates may apply.Mobile deposits are subject to limits and other restrictions. Refer to the Online Banking Agreement for details.

Santander Pay In Cheque Atm

- Day-to-day banking

Day-to-day banking

Our day-to-day banking services cover everything you need to run your company finances, from accepting credit card payments to paying your bills.

- Finance

- Structured finance

- Specialised finance

Finance

At Santander, we understand that to expand your operation you need access to finance. Here you’ll find a range of options suited to short and long-term needs.

- International trade

International

We’re focused on bringing a fresh perspective to businesses with ambitions to grow beyond traditional markets.

Our extensive local networks and knowledge around the world means we’re ideally placed to support your international trade plans. Let us help you uncover the path to international success.

- Sectors expertise

Sector expertise

Our sector specialists are here to help you prosper.

We understand the complexity and evolving needs of businesses in a wide range of industries. Our experts will work with you to help turn your aspirations into reality.

- Insights & events

Insight & events

Read the latest Santander news, market developments and insights, as well as register your interest to attend our events held across the UK.