Recurring Deposit Interest

Axis Bank’s Recurring Deposit interest rate (compounded quarterly) gives you the advantage of earning a higher rate of return on your systematic monthly deposits and gain with the benefit of compounding. Open an RD account today! Once you open a bank RD the. Are you looking for an investment opportunity where you can make regular savings and earn interest? A Recurring Deposit (RD) may be the answer for you. You can make small contributions at regular intervals and get rewarded with interest on your savings. STFC's recurring deposit scheme will be the best choice by investing fixed amount of money every month and earn good interest. Recurring Deposit: Check RD Features & Rates - STFC Toll Free No.

More Calculators:

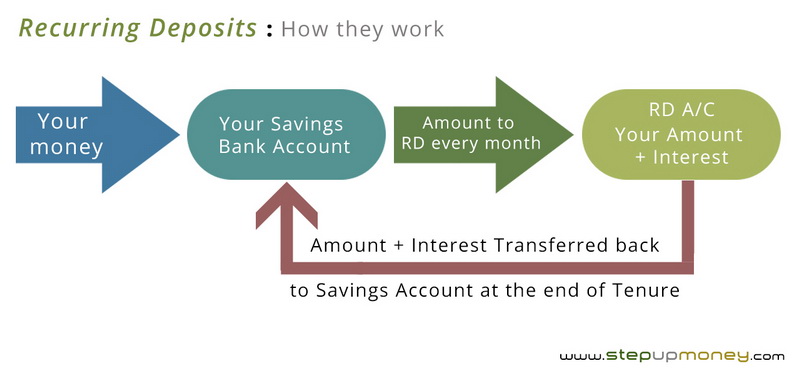

A recurring deposit is a type of term deposit offered by banks / financial institutes which assist people with regular incomes to deposit a fixed amount every month into their RD account and earn interest at the rate applicable.

Recurring deposit (RD) allows customers an opportunity to build their savings via regular monthly deposits of a fixed sum over a fixed period of time.

Recurring deposit matures on a specific date in the future along with all the deposits made every month

It is similar to a fixed deposit of a certain amount in month-to-month installments.

The minimum tenure of this deposit is six months and maximum is ten years.

Compound interest is added to recurring deposit at the end of every financial quarter.

Rate of interest of 5% to 7.25% is offered on RD by various financial institutions.

M =R[{(1+i)^n} – 1] ÷ 1-{(1+i)^(-1/3)}

M = Maturity value of the RD

R = Monthly RD installment to be paid

n = Number of months (tenure)

i = Rate of Interest / 400

Let’s consider an example to understand this better,

You invest a principal amount of 500 for a period of 60 months at an interest rate of 6% and it is compounded quarterly.

M =R[{(1+i)^(n/3)} – 1] ÷ 1-{(1+i)^(-1/3)}

M =500[{(1+(6/400))^(60/3)} – 1] ÷ 1-{(1+(6/400))^(-1/3)}

M =500[{(1+(0.015))^(20)} – 1] ÷ 1-{(1+0.015)^(-1/3)}

M =500[{(1.015)^(20)} – 1] ÷ 1-{(1+0.015)^(-1/3)}

M= 35,031.78

Maturity amount in this case at the end of 30 months will be 35,031.78.

Banks / Financial companies | Normal Interest Rates | Senior Citizen Interest | ||

less than 5 Years | More than 5 Years | less than 5 Years | More than 5 Years | |

State Bank of India | 5.30% | 5.80% | 5.40% | 6.20% |

AXIS Bank | 5.50% | 6.00% | 5.50% | 6.00% |

ICICI Bank | 5.35% | 5.85% | 5.50% | 6.30% |

HDFC Bank | 5.35% | 5.85% | 5.50% | 6.00% |

Union Bank of India | 5.45% | 5.95% | 5.45% | 5.95% |

IDBI Bank | 5.30% | 5.90% | 5.30% | 5.90% |

Kotak Mahindra Bank | 4.90% | 4.50% | 5.40% | 5.00% |

Yes Bank | 7.00% | 6.75% | 7.75% | 7.25% |

Federal Bank | 5.35% | 5.50% | 5.85% | 6.00% |

IndusInd Bank | 6.75% | 6.65% | 7.25% | 7.15% |

Punjab National Bank | 5.30% | 5.30% | 6.05% | 6.05% |

Bank of Baroda | 5.30% | 5.30% | 5.80% | 6.30% |

Bank of Maharashtra | 5.00% | 5.00% | 5.50% | 5.50% |

Indian Overseas Bank | 5.45% | 5.45% | 5.95% | 5.95% |

IDFC Bank | 6.75% | 6.25% | 7.25% | 6.75% |

Note: Please refer to the respective bank websites and confirm the interest rates before investing. The above chart is updated in August 2020.

High Interest rates.

Useful for short term goals.

A Flexible amount can be invested.

Loan on Recurring deposit

Penalty / Charges vary from bank to bank. However, it is observed that maximum of 2% of agreed upon interest rate is charged on premature withdrawing.

Please refer the below links for detailed chart on interest rates:

SBI – https://www.sbi.co.in/web/personal-banking/investments-deposits/deposits/recurring-deposit

Axis – https://www.axisbank.com/retail/calculators/recurring-deposit-calculator

ICICI – https://www.icicibank.com/Personal-Banking/account-deposit/recurring-deposits/index.page

HDFC – https://www.hdfcbank.com/personal/resources/rates

Union Bank – https://www.unionbankofindia.co.in/english/personal-recurring-deposit-scheme.aspx

IDBI Bank – https://www.idbibank.in/interest-rates.asp

Recurring Deposit Interest Formula

Kotak Mahindra Bank – https://www.kotak.com/en/personal-banking/deposits/recurring-deposits/interest.html

Recurring Deposit Calculator Online

Yes Bank – https://www.yesbank.in/personal-banking/yes-individual/deposits/recurring-deposit

Federal Bank – https://www.federalbank.co.in/deposit-rate

IndusInd Bank – https://www.indusind.com/in/en/personal/rates.html

Punjab National Bank – https://www.pnbindia.in/Interest-Rates-Deposit.html

Bank of baroda – https://www.bankofbaroda.in/interest-rates-charges.htm

Bank of Maharashtra – https://www.bankofmaharashtra.in/domestic_term_deposits

Indian OverSeas Bank – https://www.iob.in/Domestic_Rates

IDFC Bank – https://www.idfcfirstbank.com/content/dam/IDFCFirstBank/Interest-Rates/Interest-Rate-Retail.pdf

A Recurring Deposit is a simple way to save money every month and earn higher interest than you get with a

Savings Account. If you maintain a Savings Account with us, a specified amount can be automatically transferred from it every month to your Recurring Deposit. At the end of the tenure, you will have saved a considerable sum of money.

The minimum ticket size of Rs. 5,000 to a maximum of Rs. 2 lakh

- The minimum tenure is 12 months (in multiplies of 3 months thereafter)

- The maximum tenure is 60 months

- Get interest rates equal to that of regular Fixed Deposits

More Fixed Deposit options

Resident Fixed Deposit

Senior Citizen Fixed Deposit

NRI Fixed Deposit

Enjoy attractive returns with maximum liquidity with NRE or NRO Fixed Deposits.

Recurring Deposit Interest Rate Calculator

Know moreApply for Fixed Deposit

SMS FD to 561615

Call 18602666601#

#Customers outside India need to dial +91 22 6601 6601. Customers in Mumbai can also call at +91 22 6601 6601. Call charges apply.

Useful Information

- ^This is applicable only for certain tenures. Please refer to the Interest Rates for more details.

- *Conditions apply - Fixed Deposit:

• No interest is payable for all deposits withdrawn prematurely before 7 days

• Premature withdrawal: In case of premature withdrawal of fixed deposits on 7th day or thereafter, the interest rate will be 1.00% below the applicable interest rate for the deposit. The applicable interest rate will be the rate as on the date of booking for the period for which the deposit has run. This will be applicable for all deposits including renewals

• Minimum fixed deposit amount is Rs. 20,000

• Interest Rates are subject to change without prior notice

• The stated documentation is subject to change and is at the sole discretion of Deutsche Bank AG

• Deutsche Bank Tax Saver Fixed Deposit is structured to benefit you the most in terms of this provision. Amount invested up to Rs. 1.5 lakh for a fixed period of 5 years in Tax Saver Fixed Deposit is eligible for deduction under Section 80 (C) of Income Tax Act, 1961

•Loan Interest Certificate

•EMI Calculator

•Pay Tax Online

•Create IPIN Online

•Verified By Visa (VBV)

•Schedule of charges

•Fixed / Recurring Deposit Calculator

•Important Information

•Safe Banking

•Digital Signature Certificate

•Financial Results

•Privacy Policy

•Do-Not-Call Service

•Customer Feedback

•Positive Pay

Recurring Deposit Interest Rates In Axis Bank

•About Us

•Form Centre

•ATM / Branch Locator

•Awards

•Sitemap