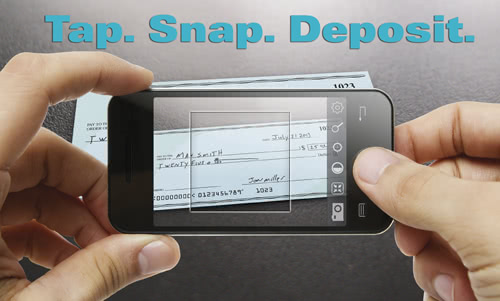

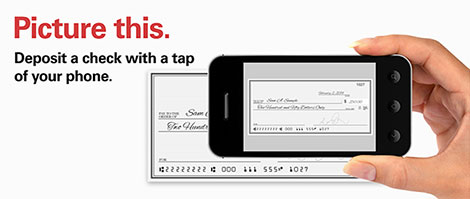

Mobile Check Deposit

For purchases by check into all funds other than money market funds, and for purchases by exchange, wire, or electronic bank transfer (not using an automatic investment plan) into all funds: If the purchase request is received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the trade date for the purchase will be the same day. If the purchase request is received on a business day after the close of regular trading on the NYSE, or on a non-business day, the trade date for the purchase will be the next business day.

Mobile Check Deposit Online

With Wells Fargo Mobile deposit (“mobile deposit”), you can make a deposit directly into your eligible checking or savings account using the Wells Fargo Mobile app. Mobile deposit lets you submit photos of the front and back of your endorsed, eligible check. Use your mobile banking app and smart-phone camera to snap a picture of the front and back of a paper check, then electronically and securely deposit it into your account. You save time and hassles. Mobile Check Load 1. Load Checks with a Snap. Load checks to your Card with your phone, using the Netspend ® Mobile App. Card usage is subject to card activation and identity verification. Mobile check deposit lets you deposit checks into your U.S. Bank account using the camera on your mobile device. Here’s how it works: Sign your check. Choose an account. Enter your check amount.

For purchases by check into money market funds: If the purchase request is received by Vanguard on a business day before the close of regular trading on the NYSE (generally 4 p.m., Eastern time), the trade date for the purchase will be the next business day. If the purchase request is received on a business day after the close of regular trading on the NYSE, or on a non-business day, the trade date for the purchase will be the second business day following the day Vanguard receives the purchase request. Because money market instruments must be purchased with federal funds and it takes a money market mutual fund one business day to convert check proceeds into federal funds, the trade date for the purchase will be one business day later than for other funds.

Mobile Check Deposit App

Ingo Money is a service provided by First Century Bank, N.A. and Ingo Money, Inc., subject to the First Century Bank and Ingo Money Terms and Conditions https://www.ingomoney.com/terms-conditions/general-sdk/ and Privacy Policy https://www.ingomoney.com/privacy-policy Approval review usually takes 3-5 minutes, but may take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Unapproved checks will not be loaded to your card. Ingo Money reserves the right to recover funds from bad checks if you knew the check was bad when you submitted it, if you attempt to cash or deposit it elsewhere after funding or if you otherwise act illegally or fraudulently. Fees may apply for loading or use of your card. See your Cardholder Agreement for details. Fees and other terms and conditions apply to check load services.

Neither Green Dot account, Green Dot Bank, Green Dot Corporation, Visa U.S.A. or any of their respective affiliates provide or are responsible for Ingo Money Products or Services.

App Store is a service mark of Apple Inc. Google Play is a trademark of Google Inc.

© 2020 Ingo Money, Inc. All rights reserved.