Direct Deposit Account

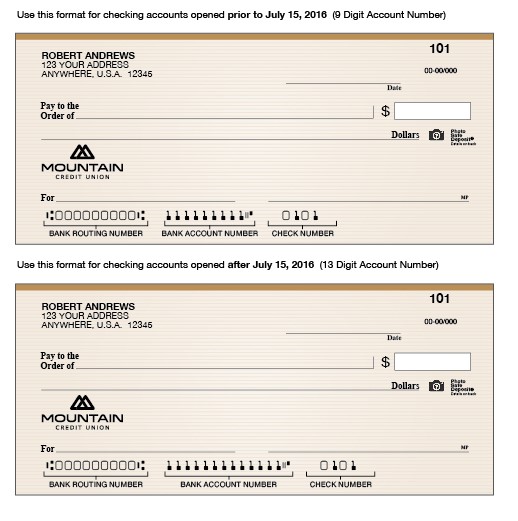

To set up direct deposit, provide the following information: The name of your bank Your bank account number, which can be up to 17 characters (see image below). On the sample check below, the. Dec 23, 2020 The new direct deposit limits will help eliminate this type of abuse. Direct deposit must only be made to accounts bearing the taxpayer’s name. Preparer fees cannot be recovered by using Form 8888 PDF to split the refund or by preparers opening a joint bank account with taxpayers. When does a direct deposit hit your account? Direct deposits arrive in accounts no later than 9 a.m. (EST) on the day the bank receives the deposit. Find a Capital One; Chase Bank. When does a direct deposit hit your account? Generally, direct deposits are posted by 6:30 a.m. (EST) on the business day the bank receives the deposit. The third set is the one you don't need for direct deposit, as it's the number of the individual check. Check this IRS page for more help with locating your routing and account numbers. If you already have direct deposit active, you will see a summary of your account information. Click Change to start a new direct deposit or to change an existing direct deposit You'll need you bank name, account number, and routing number to set up direct deposit to your checking or savings account.

A direct deposit (or direct credit), in banking, is a deposit of money by a payer directly into a payee's bank account. Direct deposits are most commonly made by businesses in the payment of salaries and wages and for the payment of suppliers' accounts, but the facility can be used for payments for any purpose, such as payment of bills, taxes, and other government charges. Direct deposits are most commonly made by means of electronic funds transfers effected using online, mobile, and telephone banking systems but can also be affected by the physical deposit of money into the payee's bank account.

When making a direct deposit by means of electronic funds transfer, the payer also normally enters reference information to make it easy for the payee to recognise who made the deposit and which account to credit. The reference may be an account number, an invoice number, the payer's name, or some other meaningful identification. To ensure that the payee is aware of the deposit, the payer commonly follows up by sending to the payee a remittance advice.

The direct deposit facility is often better known by country-specific payment systems used to action these payments such as the following:

- Giro in most of Europe

- ACH Network (ACH) in the United States

- Direct entry in Australia

Alternatives[edit]

If a funds recipient does not have a bank account, but a payer is obligated to pay by electronic funds transfer, alternative payment arrangements need to be made. For example, a US law of 1996 required the federal government to make electronic payments, such as direct deposit, available by 1999. As a part of its implementation, the US Treasury Department paired with Comerica Bank and MasterCard in 2008 to offer the Direct Express Debit MasterCardprepaid debit card, which can be used to make payments to federal benefit recipients who do not have a bank account.[1]

See also[edit]

Direct Deposit Account Type

References[edit]

- ^'Federal government chooses direct deposit and prepaid cards over mailing checks'Archived 2013-04-23 at the Wayback Machine, BankCreditNews, 15 April 2013, accessed 22 April 2013.

Direct Deposit Account For Stimulus Check